Drivers and Barriers of Adopting Interactive Dashboard Reporting in the Finance Sector: An Empirical Investigation

Keywords:

Adoption, Barriers, Drivers, Empirical Examination, Finance Sector, Interactive Dashboard Reporting, Machine Learning AnalysisAbstract

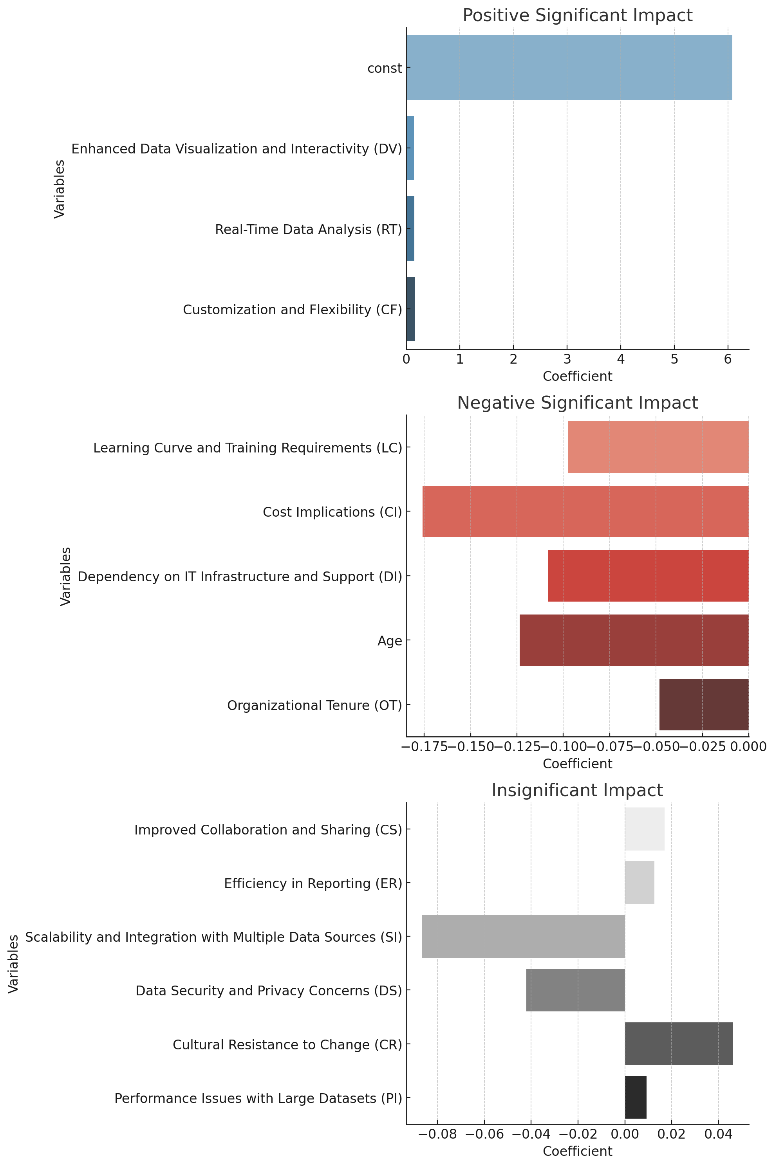

The finance sector has traditionally relied on static reporting methods for data analysis and presentation. With the advent of advanced data technologies, there has been a growing interest in interactive dashboard reporting. Interactive dashboards offer dynamic visualization and real-time data analysis, promising enhanced decision-making capabilities in financial contexts. Yet, the adoption of these advanced tools in the finance sector has been varied. The objective of this research was to empirically examine the drivers and barriers influencing the adoption of interactive dashboards as opposed to traditional static reporting in the finance sector. The study analyzed data collected from 381 professionals working in the finance sector, including roles such as financial analysts, data analysts, IT professionals, data engineers, finance managers, executives, and business intelligence professionals. The methodology of this study includes traditional regression methods and four machine learning algorithms: decision tree, random forest, support vector machine (SVM), and K-nearest neighbors (KNN). The target participants were categorized into three groups based on their adoption stance: not willing to adopt, undecided, and willing to adopt. Results from traditional regression methods indicated that enhanced data visualization and interactivity, real-time data analysis, and customization and flexibility positively impacted the willingness to adopt interactive dashboards. Conversely, age, cost implications, dependency on IT infrastructure and support, learning curve and training requirements, and organizational tenure were identified as significant barriers, negatively impacting adoption. Features such as improved collaboration and sharing, efficiency in reporting, scalability and integration with multiple data sources, data security and privacy concerns, cultural resistance to change, and performance issues with large datasets were found to have an insignificant impact on adoption decisions. In the machine learning analysis, SVM classification found to be the most accurate with a 93% accuracy rate, followed by decision tree (92%), random forest (91%), and KNN (90%). The most significant feature across all methods was age, consistently showing the highest importance. Other important features included organizational tenure and real-time data analysis, which were moderately important across most machine learning methods. Cultural resistance to change and dependency on IT infrastructure and support were also important in several methods. Customization and flexibility, along with enhanced data visualization and interactivity, were crucial in specific contexts, especially where data interpretation and user interaction are key. Less important features identified included learning curve and training requirements, performance issues with large datasets, and other context-specific factors such as collaboration and sharing, efficiency in reporting, scalability and integration, cost implications, and data security and privacy concerns. The findings of this study recommend the addressing of negative impacts such as age, cost, and IT dependency while utilizing positive aspects like enhanced visualization, real-time analysis, and customization to encourage the adoption of more dynamic and interactive reporting methods in the financial data analysis domain.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2019 Author

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Publication Licensing Terms:

Copyright: Authors retain copyright, granting the journal first publication under a Creative Commons Attribution (CC BY) license.

Licensing: The CC BY license allows any use with proper attribution and a link to the journal's website.

Author's Warranties: Authors confirm their work is original and does not violate any third-party rights.

Reuse and Distribution: Authors are free to share their work online after publication.

Attribution: Users must credit the work as specified under the CC BY license without suggesting author endorsement.

Responsibility: Authors bear responsibility for copyright infringement issues.